Part 3 - 30 Different Ways to Build a Billion Business

15 Jan 2018

Abstract

If you have not yet read the 1st and 2nd post - we highly recommend that you do for context. You can find it here:

- 30 different ways to build a 1 billion business (Part 1), and follow with

- Article 2 -30 Different ways to build a billion business (Part 2).

In these blog posts, some well-known international and potentially lesser known examples from South Africa or neighbouring countries are included. These blog articles are aimed at business readers, ranging from corporate executives to entrepreneurs and founders searching for strategies to increases revenue. It is equally suitable for interested parties who wish improve their general knowledge around strategies and growth.

Estimated reading time: 6.5 min or less

This post is the 3rd part in series of blog posts focussing on various approaches to increase company revenue/turnover. Each approach is discussed in brief with examples.

The full series will contain 4 articles.

===========

0. Background

In Part 1 and Part 2 of this blog, we looked at the roles of the following factors in achieving revenue target:

1. Product & Market Mix

2. Price

3. Volume

4. Demand

In this blog, we continue the discussion on demand and also look at the role of innovation.

4.3.5 Satisfy more of the demand - Integrate vertically or horizontally

Most businesses form part of a supply value chain of sorts. There are usually at least four phases of the typical product supply chain:

Commodities -> manufacturing -> distribution -> retail.

E.g. A forestry company grows trees in their plantation -> trees are cut and send to a lumber mill to saw into planks -> a wholesale wood merchant resells the planks -> a furniture factory buys the wood to make furniture -> shop sells the final product to an end-consumer.

At each step of the process, different activities can take place and (usually) more value is added, typically by different role players. When 2 or more stages are combined within 1 business (or family of businesses) vertical integration is taking place.

- Backward Vertical Integration is when a company downstream in the value-chain takes on activities which normally happen higher up – e.g. when a supermarket buys a farm to grow its own vegetables for resale.

- Forward Vertical Integration is when a company higher up in the stream takes on activities which normally happen lower down – e.g. when a mine commences with beneficiation of its own minerals.

- Horisontal Integration is when a company takes over the activities of other role players at the same level in the value chain – e.g. buying out competitors and merging them into itself.

There are various benefits to integration (horizontal or vertical):

- Integrated firms have competitive advantage in that they can compete at more competitive or lower rates, and or are able to extract higher profits to bigger cost savings from integration,

- Due to controlling their own suppliers (in the case of vertical integration) such business are less prone to external supply chain disruptions,

- Integration allows benefits of scale – both in the case of vertical and horizontal integration. Integrated firms can buy in bulk and achieve higher cost savings per unit,

- Integrating with suppliers, retailers or competitors can give access to new markets, technologies, competencies, scale

- Integrated firms can respond faster to competitors or new products.

Examples of integration (horizontal or vertical):

DEBSWANA

- In the case of Forward Vertical Integration, Debswana, a mining company based in Botswana, is a good example. Debswana is a joint venture between De Beers and the Botswana Government.

- Prior to 2013, Debswana would mine raw diamonds and then typically send these overseas for processing. In 2013 they opened a diamond beneficiation plant (DBGSS) in Gaborone to take responsibility for sorting and valuing of rough diamonds, cutting and polishing, and also got involved in the manufacturing of diamond jewelry. All of which are high value-adding activities, and all of these activities would previously have happened off-shore – in this case mostly in and around London, UK.

|

| Fig 1.1 Jwaneng mine, Courtesy of Debswana |

- The benefits of local beneficiation to the economy have been significant. Thousands of direct and indirect jobs were created, even in un-related industries like tourism. In 2014, DBGSS completed its first full year of operation in Botswana and directly contributed US$380 million to the GDP, contributing more than the entire agricultural sector in the same period.

STEINHOFF

- Steinhoff is another example of vertical integration, albeit a controversial inclusion on this list. The group has been in the news for all the wrong reasons lately: top management resignations, allegations of mismanagement and accounting scandals ... so I had some debate with myself whether or not to include them here.

- While we agree that they might not be a good example of accounting excellence per se, they remain a good example of an integrated retailer that manufactures, sources and retails furniture, household goods and general merchandise around the world. In specific markets, they control substantial portions of the supply chain from manufacturer to retailer. Before the near catastrophic drop in market value late in 2017, Steinhoff ranked as the world’s second-biggest furniture retailer after IKEA.

COMAIR

- Comair is the local operator for British Airways and Kulula (a South African discount-airline similar to the UK's Ryan Air). They were frustrated by delays and the quality of food from outsourced vendors, and opened their own air catering company called Food Directions (forward vertical integration). The use of their own in-house food services saved them R 30 million per year, in addition to generating revenue from providing similar catering services to other airlines.

FAMOUS BRANDS

- Famous Brands, the owner of various large restaurant and fast chains including Steers, Debonairs Pizza, Wimpy, Mugg & Bean, and Tashas, had 2 614 outlets across the country by mid-2016. It is interesting to note the extent to which Famous Brands embraced vertical and horisontal integration.

- Not only do they own their own logistics business with 8 logistic centers of excellence across the country, they manufacture food ingredients too. This has been achieved by acquiring one of SA’s biggest producers of French fries and other potato-based products, also a tomato paste factory expected to reach R 100 mil turnover, taking over Coega Cheese Company and rebranding as Famous Brands Fine Cheese Company, and buying or setting up various other companies to supply bread from its own bakeries, coffee, juice, meat, spices, ice cream, even right down to serviettes from its own serviette factory.

|

| Fig 1.2 - Steers, one of many brands in the Famous Brands stable |

- No wonder then that Famous Brands reported an increase of 33% to R5.7 Billion in Revenue and operating profit Up 18% to R938 Million for 2017

AB InBev

- One of the biggest horisontal integrations (mergers) in recent times that hogged the headlines for months during 2015-2016, also with strong South African roots - The more than $100 billion merger between Anheuser-Busch InBev (AB InBev) and SABMiller. This merged the world number 1 producer and 2nd largest producer in the world. This was the 3rd largest acquisition in history and the largest ever in Britain. The post-merger firm would be the world biggest beer producer, and the 5th biggest Consumer Goods Company in the world, controlling up to 33% of the world beer market from the word go.

|

| Fig 1.3 - Some of the combined labels and brands in the new company |

- Through this acquisition, InBev gained access to new markets in China, South America and importantly, to the African growth market, where SABMiller previously had the local market pretty much stitched up with an extensive logistical footprint and manufacturing capacity. Africa is seen as a key growth market for beer, with anticipated growth to 2025 of 44%, which is almost 3x the global growth rate. Similarly, SABMiller would gain access to the South American market, controlled by Inbev.

- This merger is anticipated to unlock pre-tax synergies in the region of $ 1 billion p.a. over areas of procurement, engineering, brewery and distribution, regional head offices and best practices.

PIONEER FOODS

- In 2015 Pioneer Food Group (Pioneer), the leading breakfast cereal producer in South Africa, announced that it was planning to enter into a joint venture (JV) with Future Life Health Products (Future Life). Pioneer makes popular breakfast cereal brands such as ProNutro, Weet-Bix and Bokomo Limited, while Future Life focusses on scientifically formulated nutrient-dense functional food products. This merger gave Pioneer access to expertise as well as entrance to the health food market, as well as access to different geographical markets.

4.4 Innovate

Do not underestimate the importance and revenue increasing possibilities that innovation can bring to the table. PWC interviewed board-level executives from 1 757 companies, across more than 25 countries and 30 sectors and published a report called “Breakthrough innovation and growth” in 2013.

Amongst various other findings, they found that:

- 79% of the most innovative companies in the study had well-defined innovation strategies, compared with only 47% of the least innovative companies.

- The most innovative are planning a wider range of innovative operating models – e.g. the top 20% were 2x as likely to consider corporate venturing as a means to drive growth.

- Innovation is a growth multiplier. They tracked the performance of the top 20% most innovative companies out of a sample of 1 757 companies, over a period of 3 years, based on publicly available information. Their findings: the most innovative 20% had grown at a rate 16% higher than the least innovative. This equated, on average, to each of the most innovative companies delivering $0.25bn of additional revenue over the last three years, compared with the least innovative.

4.4.1 Develop new products or services and find new markets

The principle of Blue Ocean Strategy applies here – find, or create new markets to compete in with new products or services for which there is not yet any competition.

Take coffee as example: According to legend, somewhere in the 11th century, an Ethiopian goat herder called Kaldi noticed something peculiar: when his goats ate berries from a specific tree they became very energetic. Kaldi went to report his discovery to the abbot of a local monastery. The rest, as they say, is history. So the coffee market is not exactly new. Enter Nespresso stage left, an autonomous part of the Nestle group. Around 1986 they had a simple idea: enable anyone to create the perfect cup of coffee, just like having a skilled barista at home, or at the office. They launched into B2C and B2C sectors, launched an e-Commerce website in 1998, then launched their first stand-alone boutique store in 2000.

|

| Fig 1.4 - Nespresso |

Nespresso developed a hybrid business model, partly integrated and partly outsourced, disrupting the typical coffee business model and supply chain. The perfect coffee machine was designed jointly with external design partners and specialists to perfect taste, temperature and water pressure – 1 700 patent applications were filed in this process. To this day

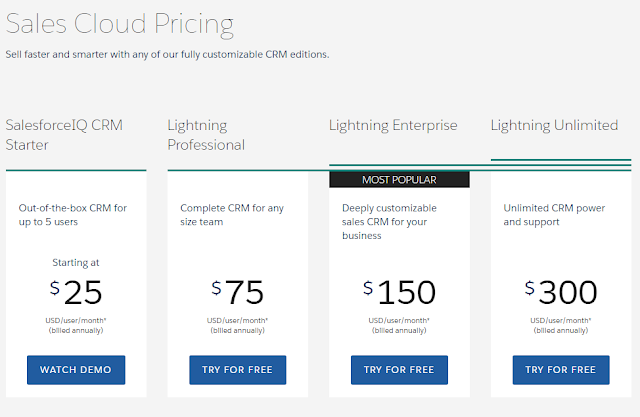

Nespresso’s revenue is based on the following logic:

- High-quality coffee machines are sold for a reasonable price through licensing partners. Nespresso does not profit from coffee machines

- Income primarily comes from Nespresso capsule sales. Gross margins are estimated around 85%, compared with 40% - 50% for traditional competitors.

- Secondary income comes from cross-selling of coffee accessories.

Fast forward to 2015, by which time Nespresso had grown its presence to 64 countries worldwide, more than 12,000 employees and 450 Boutiques selling coffee, machines and accessories. By 2015 they had 10 million registered customers and over 320,000 customers visiting the company’s e-commerce platforms daily. Nespresso was the worldwide leader of the “portioned coffee” industry, with estimated annual sales of over CHF 4bn.

How did they do it? Nespresso’s key growth drivers focussed on:

- Market segmentation, Unique value proposition and business model innovation;

- Consistently highest quality products and services;

- Creating long-lasting relationships with customers and suppliers, including the coffee supply chain;

- Effective sales and marketing as well as sustainability of the business.

Summary (Part 3)

In previous posts, we looked the role of product mix, price, volume, and experimenting with demand. In Part 2 of this series of blog posts we looked at other examples of diversification, integration, as well as innovation - all of which can play a very significant role in achieving target Revenue. Please note there is at least 1 more blog post to follow in this short series dealing with ways to increase turnover.

If you liked this blog post, please share or tweet or repost this article to others who may also be interested in these topics.

Did you gain any new insights regarding diversification, integration or innovation? Which other strategies specific to volume and demand have you used to increase revenue?

Also why not subscribe? Simply scroll up and enter your email on the top right for notifications. We publish approx 1-2 posts per month on business-related topics.